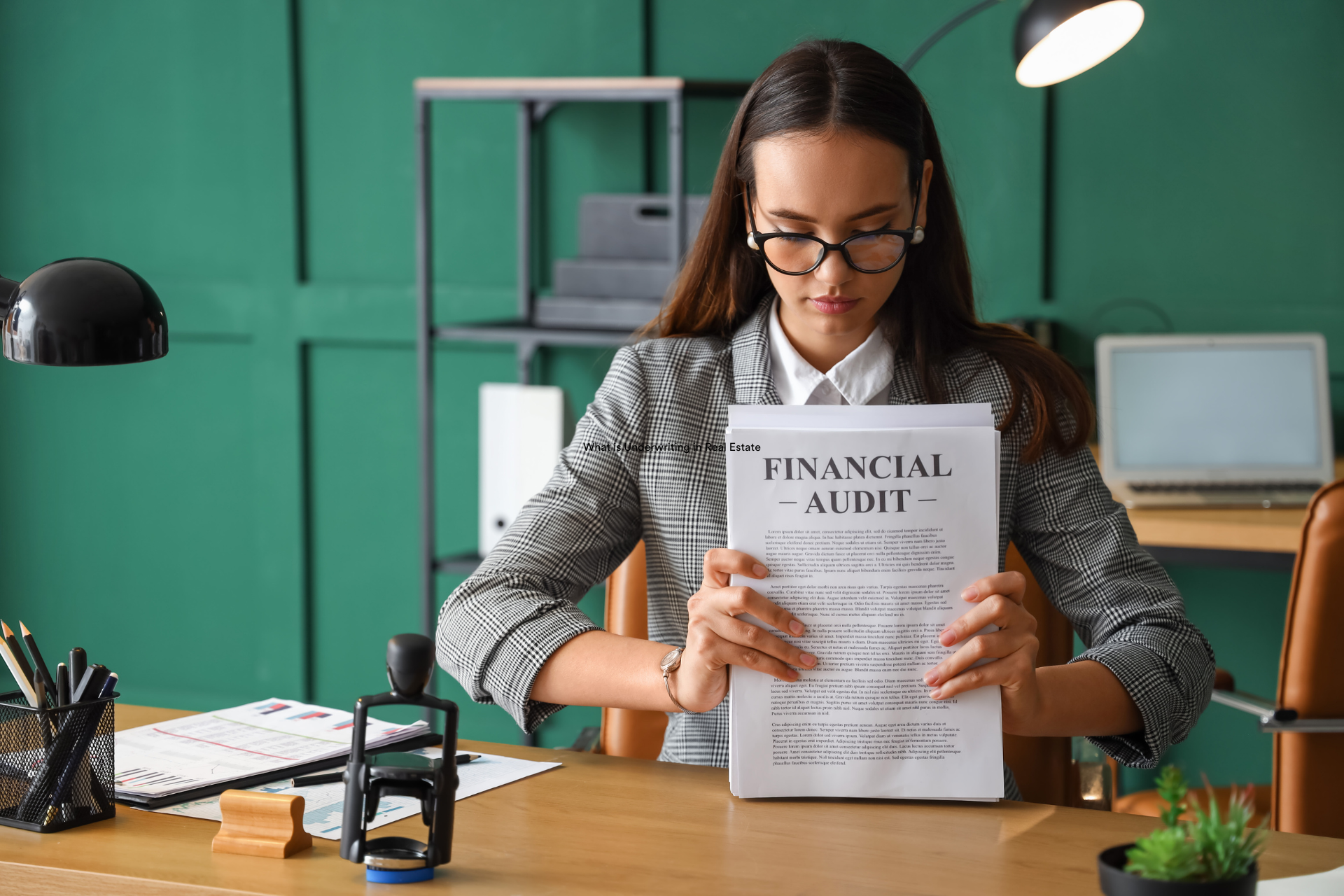

Underwriting plays a crucial role in the real estate industry by assessing the financial viability and risk associated with potential investments. It involves a thorough analysis of various factors to determine the feasibility of a project and ensure its profitability. This article explores the definition and purpose of underwriting, the role of underwriters in real estate, key factors considered in underwriting, and the importance of underwriting in real estate investments.

Key Takeaways

- Underwriting is the process of evaluating the financial viability and risk associated with real estate investments.

- Underwriters in real estate play a critical role in assessing the feasibility and profitability of projects.

- Key factors considered in underwriting include market conditions, property valuation, cash flow analysis, and borrower's creditworthiness.

- Underwriting helps mitigate risks and ensures informed decision-making in real estate investments.

- Thorough underwriting is essential for successful real estate investments and minimizing potential losses.

Understanding Underwriting in Real Estate

The Definition and Purpose of Underwriting

Underwriting plays a crucial role in the world of real estate investment. It is a process that involves assessing the financial viability and risk associated with a potential investment. Haliburton Real Estate understands the importance of thorough underwriting to make informed decisions and mitigate risks.

During the underwriting process, various factors are considered to determine the feasibility of a real estate investment. These factors include the property's location, market conditions, potential rental income, expenses, and projected return on investment. Underwriters analyze these factors to assess the potential risks and rewards of the investment.

One of the key purposes of underwriting is to ensure that the investment aligns with the investor's goals and objectives. By carefully evaluating the financial aspects of a potential investment, underwriters can provide valuable insights and recommendations to investors.

It is important to note that underwriting is not a one-size-fits-all approach. Each investment opportunity requires a unique evaluation based on its specific characteristics and market conditions. Therefore, underwriters play a critical role in providing customized analysis and recommendations for real estate investments.

The Role of Underwriters in Real Estate

In the world of real estate investment, underwriters play a crucial role in evaluating the financial viability of a project. Underwriters, such as those at Haliburton Real Estate, are responsible for assessing the risks associated with a potential investment and determining whether it aligns with the company's investment criteria.

Underwriters analyze various factors to make informed decisions. They carefully review the property's financial statements, market conditions, and the borrower's creditworthiness. By conducting thorough due diligence, underwriters ensure that the investment is sound and has the potential for a positive return.

To effectively carry out their role, underwriters must possess a deep understanding of the real estate market and industry trends. They need to stay updated on market conditions, property values, and regulatory changes that may impact the investment. This knowledge allows them to make informed decisions and mitigate potential risks.

In addition to evaluating the financial aspects, underwriters also consider the property's location, potential for growth, and the overall market demand. By taking these factors into account, they can assess the long-term viability and profitability of the investment.

Underwriters are the gatekeepers of real estate investments, ensuring that only the most promising opportunities are pursued. Their expertise and thorough analysis provide investors with the confidence to make informed decisions and maximize their returns.

Key Factors Considered in Underwriting

When it comes to underwriting in the real estate industry, there are several key factors that are carefully considered. These factors play a crucial role in assessing the viability and profitability of an investment in the Haliburton Real Estate market.

One of the primary factors is the location of the property. The location can greatly impact the potential return on investment. Factors such as proximity to amenities, transportation, and desirable neighborhoods are all taken into account.

Another important factor is the condition of the property. Underwriters assess the current state of the property, including any necessary repairs or renovations. This helps determine the overall value and potential future value appreciation.

Additionally, underwriters analyze the financial aspects of the investment. This includes evaluating the income potential, expenses, and cash flow projections. They also consider the borrower's financial stability and creditworthiness.

Lastly, underwriters assess the market conditions and trends in the real estate industry. They analyze factors such as supply and demand, interest rates, and economic indicators to gauge the potential risks and rewards of the investment.

By carefully considering these key factors, underwriters are able to make informed decisions regarding real estate investments, ensuring the best possible outcomes for both investors and lenders.

The Importance of Underwriting in Real Estate Investments

Underwriting plays a crucial role in the world of real estate investments. It is a process that involves assessing the risks and potential returns of a particular investment opportunity. Haliburton Real Estate understands the significance of thorough underwriting in making informed investment decisions.

By conducting a comprehensive underwriting analysis, investors can evaluate the financial viability of a real estate project. This includes assessing factors such as the property's location, market conditions, rental income potential, and projected expenses. The goal is to determine whether the investment aligns with the investor's financial goals and risk tolerance.

In addition to financial analysis, underwriting also involves conducting due diligence on the property. This includes reviewing legal documents, property inspections, and assessing any potential risks or liabilities. By thoroughly examining all aspects of the investment, underwriters can identify any red flags or issues that may impact the investment's success.

A key benefit of underwriting is its ability to mitigate risks. By carefully analyzing and evaluating the investment opportunity, underwriters can identify potential risks and take appropriate measures to minimize them. This helps investors make more informed decisions and reduces the likelihood of unexpected financial losses.

In summary, underwriting is an essential process in real estate investments. It allows investors to assess the financial viability of an investment opportunity, conduct due diligence, and mitigate risks. Haliburton Real Estate recognizes the importance of thorough underwriting in ensuring successful and profitable investments.

Conclusion

Underwriting plays a crucial role in the real estate industry. It involves assessing the financial viability and risk associated with real estate investments. Underwriters are responsible for evaluating various factors such as the property's value, market conditions, and borrower's creditworthiness. By conducting thorough underwriting, investors can make informed decisions and mitigate potential risks. Underwriting is an essential process that ensures the success and profitability of real estate investments.

Frequently Asked Questions

Learn More